Eat Just Inc., the cell-cultured meat enterprise established by entrepreneur Josh Tetrick, is being sued by suppliers ABEC Inc. and CRB Builders for breach of contract including non-payment for services, equipment installations and structures intended to produce Eat Just products.

In early 2022, Eat Just and its Good Meat subsidiary entered into a seven-year contract with ABEC to design, manufacture and install ten reactors that would have been necessary to undertake commercial production of cell-cultured meat at the scale designated by Eat Just. The complaint alleges that although ABEC delivered on its commitments including construction of pilot scale bioreactors in the U. S. and Singapore, Eat Just has ignored invoices to the value of $30 million. ABEC claims that they committed $280 million to purchase orders placed by Good Meat through the end of 2022. By early March, ABEC was pressing for payment.

In early 2022, Eat Just and its Good Meat subsidiary entered into a seven-year contract with ABEC to design, manufacture and install ten reactors that would have been necessary to undertake commercial production of cell-cultured meat at the scale designated by Eat Just. The complaint alleges that although ABEC delivered on its commitments including construction of pilot scale bioreactors in the U. S. and Singapore, Eat Just has ignored invoices to the value of $30 million. ABEC claims that they committed $280 million to purchase orders placed by Good Meat through the end of 2022. By early March, ABEC was pressing for payment.

In the case of CRB, Eat Just and its subsidiary agreed to pay for design and construction work but had only paid $760,000 with the plaintiff claiming it is owed $4.3 million for services, deliverables, expenses and interest.

Perhaps both ABEC and CRB bear some blame for their respective situations since they were embarking on multi-million dollar projects without assurance that funding or guarantees were available.

Perhaps both ABEC and CRB bear some blame for their respective situations since they were embarking on multi-million dollar projects without assurance that funding or guarantees were available.

A spokesperson for Eat Just claims that the company has to date raised more than $850 million including $270 million for Good Meat. If this is, the case, it would have been easy for the company to have written a checks to creditors without suppliers having to resort to litigation.

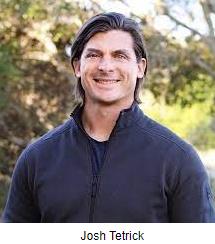

In legal parlance, the cases of ABEC, Inc. v. Eat Just and GOOD Meat, filed in the U.S. Eastern District of Pennsylvania and CRB Builders v Good Meat filed in U.S. Western District of Missouri are classic cases of caveat venditor (seller beware). It should have been incumbent on ABEC and CRB to have undertaken an evaluation of the potential for profit from large-scale production of cell-cultured meat. The suppliers should also have investigated the business history of the founder, Josh Tetrick, with his pattern of successively raising funds from cupid venture capital investors based on hype regarding welfare, sustainability and the prospect of displacing conventional livestock production. It is questioned whether they considered the return (or loss) on investment in his ersatz mayonnaise and egg substitute businesses over a two-decade period. Whatever happened to “Character, Capacity and Collateral as determinants of creditworthiness? Have elaborate slide decks and spread sheets replaced common sense and business acumen?

The Catch-22 situation with vegan egg and cell-cultured meat is that there is a small potential market comprising only the affluent and curious for these high-priced products manufactured in limited quantities. The capital cost of transition from pilot to commercial production to achieve economies of scale mitigates against the prospect of a return on investment due to the limited future market, notwithstanding greater output. This reality is reflected in the published losses generated by Beyond Meat and Maple Leaf Foods for their meat alternatives. Plant-based substitutes for real meat and eggs are less capital intensive and technically complicated than cell-cultured meat and poultry representing higher risk.

It is evident that he business of cell-cultured meat is not producing cell-cultured meat for sale. It appears to be an exercise in hyping sustainability to raise funds from gullible investors.