A consortium of 27 former leaders of agricultural associations representing row crops, livestock, biofuels in addition to prominent farmers, retired academics and former USDA administrators combined to address a letter to the leadership of the House and Senate Agricultural Committees emphasizing the perilous state of farmers and agriculture in the U.S.

The collective experience of the signatories to the letter probably exceeds a thousand years. They include CEOs of the American Soybean Association, National Corn Growers Association, US Grains Council, the Renewable Fuels Association, the National Pork Producers Council and Directors of State Departments of Agriculture and Administrators of Land-grant colleges.

The collective experience of the signatories to the letter probably exceeds a thousand years. They include CEOs of the American Soybean Association, National Corn Growers Association, US Grains Council, the Renewable Fuels Association, the National Pork Producers Council and Directors of State Departments of Agriculture and Administrators of Land-grant colleges.

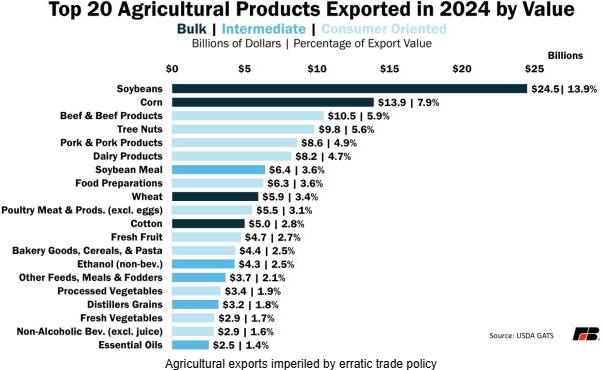

The letter noted the alarming increase in bankruptcies among family farms and the growing agricultural trade deficit. Soybean exports have fallen from 47 percent of the world market share in 2018 to 24 percent at present. Producers in South America including Brazil have gained market share at the expense of U.S. farmers.

The major points of contention relating to Administration policy that impact farmers include: -

- Tariffs on imported fertilizers and machinery.

- Tariff policy that has eroded international trade partnerships coupled with bellicose rhetoric and threats. Erratic decisions on tariffs have seriously degraded the image of the U.S. as a reliable supplier and trade partner. The Administration has failed to negotiate meaningful trade agreements during the current term of office. Withdrawal from the Trans-Pacific Partnership in 2016, deprived farmers of export markets estimated at over $4 billion each year. Concurrently the BRICS group of nations is competing against the U.S. The MERCOSUR countries have created free-trade agreements with the EU and Canada is establishing links with the People’s Republic of China.

- Cuts to domestic and foreign food assistance programs based on ideology have resulted in unintended consequences that have directly affected farmers who supplied commodities to foreign aid and SNAP programs.

- The Administration has not fully supported the biofuels program that is critical to the profitability of both corn and soybean farmers. The Administration has granted refinery exemptions and has neglected to pressure Congress to allow year-round marketing of E15 blend.

- The Administration has neglected to reform and expand the H-2A visa program. This omission coupled with mass deportations of undocumented workers has reduced the labor pool available to dairy, produce and fruit farmers and to meat packers.

- Reduction in the USDA complement by forced attrition, unproductive reorganization and intended relocation of employees has weakened the capacity of the department to serve farmers. Cuts in research grants to academia and cancellation of departmental programs not only affect current agriculture but will place the U.S. in a noncompetitive situation over years to come.

|

In an attempt to buttress eroding farmer support for the Administration, $11 billion has been made available for “Farmer Bridge Assistance” with a promise of an additional $15 billion. The letter to Congressional committees clearly stated, “Farmers do not want government handouts – they want markets.” The letter continued “They want world-class research so that they can compete. They want their families and communities to have affordable healthcare services.”

In an attempt to buttress eroding farmer support for the Administration, $11 billion has been made available for “Farmer Bridge Assistance” with a promise of an additional $15 billion. The letter to Congressional committees clearly stated, “Farmers do not want government handouts – they want markets.” The letter continued “They want world-class research so that they can compete. They want their families and communities to have affordable healthcare services.”

The signatories recommended nine steps required to reverse the crisis in agriculture and place the farm economy on a dependable footing: -

- An immediate exemption from tariffs on all farm inputs

- Establishing a rational tariff structure with removal of impositions that disrupt traditional, existing and future markets for agricultural commodities.

- Extending Trade Promotion Authority (TPA) leading to free-trade agreements.

- Entering into meaningful negotiations and trade agreements with existing and prospective importers of U.S. commodities.

- Completing the review of the USMCA and extending the agreement for 16 years.

- Allowing nationwide E15 sales year-round.

- Finalizing and enacting the Farm Bill that expired in September 2025.

- Reforming labor legislation including a new and extended H-2A program.

- Restoring funding for land-grant agriculture research and rehiring USDA scientists that were capriciously terminated by DOGE and by unstructured reorganization.

- Reestablishing domestic and international food aid programs.

The letter addressed to the House and Senate Agricultural Committees urged hearings to gather input that could lead to cancellation of deleterious programs based on political ideology and to establish realistic policies to address the farm crisis. Hearings would be a necessary first step in attempting to restore the financial health of farms and to establish long-term competitiveness for U.S. commodities and to secure international markets.

It is considered significant that the expression of complaints and the list of required changes was signed by past presidents and CEOs of agricultural organizations. Is this attributed to the fact that current leaders cognizant of problems are restrained from expressing their views based on fear of retribution for expressing opinions or advancing suggestions that are considered critical to the Administration? Due to the prevailing current of intimidation is it imprudent for seated presidents and CEOs of commodity groups and academics to express their views?

Editorial postscripts:-

A draft of the House version of the delayed Farm Bill will be released in late February but will face opposition. The Senate has yet to introduce a text of their version

A February 5th ageement with Argentine will allow a TRQ of 80,000 metric tons of beef for 2026 1n 20,000 ton tranches. It is unknown whether Argintine would be capable or willing to divert whole muscle cuts from established imorters to th U.S. market

The USDA has released funding according to legislation passed in early 2025 to expanded Matket Access and Foreign Market Development Programs