|

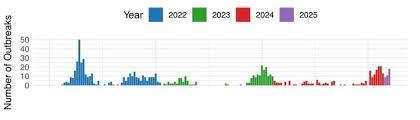

This special edition of EGG-NEWS provides commentary on recent publications, reports and events relating to highly pathogenic avian influenza (HPAI). As of mid-April, outbreaks have ceased among large egg production and pullet rearing complexes. Notwithstanding this hiatus, evident since the beginning of March, incident cases are reported among backyard flocks, turkey growing facilities and at live bird markets suggesting extension from reservoirs of infection. Cessation of new cases in large egg production complexes is attributed to the end of seasonal migration of waterfowl that have now settled into their annual breeding cycle. Sporadic cases are probably due to shedding of H5N1 virus by non-migratory domestic birds. Given experience in recent years we can anticipate a resurgence of infection in the fall as the southward migration commences impacting farms along the Pacific, Central and Mississippi flyways. This period of low HPAI activity should be used to strengthen biosecurity and to initiate protective vaccination of rearing pullets in high-risk areas in order to develop an immune population that will be challenged during the third and fourth quarters of 2025.

|

Noteworthy publications and events over the past two weeks relating to HPAI are reviewed for the benefit of subscribers:-

HPAI Vaccination Work Group Submits Proposal

A working group comprising Drs. John Clifford, Craig Rowles, Travis Schaal and David Swayne distributed a proposed vaccination plan dated April 1, 2025, to respond to highly pathogenic avian influenza (HPAI) in the U.S. egg industry. The Working Group was convened by the United Egg Producers and the American Egg Board representing U.S. egg producers. The document includes factual information on the availability and efficacy of vaccines and incorporates sections on monitoring for effective immunization and surveillance to facilitate certification for export.

Essentially the document confirms what many in the industry have recognized as the futility of the USDA-APHIS response of attempting to ‘stamp out” the endemic infection given the unprecedented depopulation of over 130 million egg laying hens on more than 130 farms since the onset of the current H5N1 epornitic that commenced in 2022.

The summary correctly maintains that “a new approach to reduce layer and pullet flock susceptibility to HPAI virus should be considered to increase resistance to infection, reduce viral shedding and importantly reduce the risk of a potential mutation event that may lead to further HPAI infection in human.” The document suggests a program under which flocks could be vaccinated with a priority for replacement pullets. The report correctly stresses the need for high levels of biosecurity, echoing the recommendations of the World Organization of Animal Health.

Vecor vaccination in ovo or S.Cut to chicks with booster |

Oil-emulsion vaccine im during rearing |

The report failed to stress the impact of flock depletion on egg prices and the cost to consumers that exceeded $15 billion in 2022 and considerably more in 2024 with an additional escalation in prices peaking at $8.50 per dozen at retail in late February 2025, reflecting the loss of approximately 30 million hens over an eight-week period.

The zoonotic potential of H5N1, deserved more than seven lines in a text extending over 13 pages. Virologists and epidemiologists involved in monitoring aspects of the molecular biology of influenza have constantly stressed the risk of emergence of a zoonotic strain of H5N1 with possible human-to-human transmission.

The zoonotic potential of H5N1, deserved more than seven lines in a text extending over 13 pages. Virologists and epidemiologists involved in monitoring aspects of the molecular biology of influenza have constantly stressed the risk of emergence of a zoonotic strain of H5N1 with possible human-to-human transmission.

One of the authors of the report is a distinguished researcher and has extensive experience in international regulation of avian diseases. A member of the committee authoring the document is a prior Chief Veterinary Officer of the USDA responsible for the response to the 2015 HPAI epornitic. Following retirement, he has served as an advisor to the USA Poultry and Egg Export Council that has a single-purpose commitment to maintaining the export volume of broiler leg quarters. It does not appear from the document that his affiliation in any way affected his scientific objectivity. It would have been possible to have made a more definitive and stronger case for vaccination with a broader representation from among the industry.

The return of incident cases during the fall migration of waterfowl is inevitable. The current ongoing outbreaks may be attributed to resident avian and mammalian carriers. Recognition that the infection can be transmitted by the aerogenous route invalidates even strict structural and operational biosecurity and places large complexes with power ventilation at risk. The need for vaccination especially in high-risk regions along the Mississippi and Pacific flyways is self-evident. The proposal to vaccinate pullets is obvious but will delay creation of an immune population due to the biological time restraints associated with rearing.

The report notes, “Vaccination of caged in-lay hens is challenging and potentially unachievable in cage-free operations.” This appears to be a questionable assertion. When the industry was confronted with severe coryza in 2023, egg producers effectively administered oil emulsion vaccines by the intramuscular route to hens in both cages and aviaries in the face of infection.

This commentator strongly supports the recommendation contained in the summary, “The industry believes that it time to enhance our overall strategy to control the virus through implementing vaccination in egg laying flocks.” In contradistinction he final paragraph relating to “acceptability to the federal government, state animal health officials” is the major defect of the report inducing a wishy-washy, non-definitive approach ending with “We look forward to further discussion with USDA about the proposal.”

Effectively if the broiler segment of the poultry industry is still opposed to vaccination of egg production flocks and possibly growing turkeys in high-risk regions, despite appropriate monitoring and surveillance, all we will have is more discussion and temporizing without action. The so-called four-pronged program advocated by the newly appointed Secretary of Agriculture is effectively smoke-and-mirror, more of the same widow dressing. It appears that USDA-APHIS either through disinclination to accept realities or acting under the duress of exporters will continue to discuss, research, evaluate, and consider vaccination while continuing to implement whack-a-mole flock depopulation at the expense of taxpayers, producers and consumers. The essence of the report is reminiscent of the sentiments attributed to St. Jerome who prayed for chastity-- but not right away.

Prominent Health Advocate Comments on the Need for Vaccination Against HPAI

Dr. Scott Gottlieb, a physician, investor in medical companies and a director of pharmaceutical enterprises previously served as the 23rd Commissioner of the Food and Drug Administration in the first administration of President Trump. He recently authored a commentary pointing to the need for vaccination of poultry flocks using currently available commercial off-the-shelf products. In his commentary he justifiably castigated Robert F. Kennedy, Jr., Secretary of the Department of Health and Human Services, who advanced the inane suggestion that HPAI should be allowed to spread unchecked through flocks in the hope that a few survivors would express genes for resistance to avian influenza.

Dr. Scott Gottlieb, a physician, investor in medical companies and a director of pharmaceutical enterprises previously served as the 23rd Commissioner of the Food and Drug Administration in the first administration of President Trump. He recently authored a commentary pointing to the need for vaccination of poultry flocks using currently available commercial off-the-shelf products. In his commentary he justifiably castigated Robert F. Kennedy, Jr., Secretary of the Department of Health and Human Services, who advanced the inane suggestion that HPAI should be allowed to spread unchecked through flocks in the hope that a few survivors would express genes for resistance to avian influenza.

Dr. Gottlieb correctly maintains that the egg industry must use the current seasonal quiescent stage of the epornitic before resumption of migration in the fall to establish immunity among flocks at risk. He expresses this sentiment as, “We have vaccines for bird flu made by American companies and used overseas but so far federal officials don’t seem poised to use them here.” He points to the deployment of vaccines in France, China and Mexico among other nations and cast doubt on the various distortions of science advanced by opponents of vaccination to support ongoing exports of broiler leg quarters.

Applying logic and common sense, Dr. Gottlieb notes that, “The avian influenza strains now in circulation have persisted continuously among birds and mammals for nearly two years and there’s growing evidence that it could become a permanent feature of North America – part of a the new normal to which the poultry industry must inevitably adjust for both the physical and economic health of Americans.”

Influenza H5N1 is clearly endemic in the U.S. and in the poultry industries of many nations. The incidence rate can be suppressed to some extent by strict structural and operational biosecurity involving investment and management. Notwithstanding the stringency of biosecurity, there is little that can be done to prevent aerogenous transmission especially into power-ventilated houses located on multi-aged egg production complexes.

Avian influenza is effectively The Newcastle Disease of the 2020s. During the 1970s Velogenic viscerotropic Newcastle disease (VVND=END) in Europe, Asia and Africa was in every way as catastrophic as avian influenza but was effectively controlled principally by vaccination supported by biosecurity.

It is questioned why a clear thinking and well-connected physician should have a greater appreciation of the risks, consequences and potential control measures to reduce the economic and potential zoonotic impact of avian influenza compared to the administrators of USDA-APHIS. Is the firm recommendation for vaccination advanced by Dr. Gottlieb an expression of epidemiologic reality or is it that Dr. Gottlieb is an independent scientific voice unfettered by conflicts of interest?

Introduction of the SAVE Our Poultry Act

U.S. Representatives Sarah McBride, (D-DE) and Mike Lawler, (R-NY) introduced the Supporting Avian Virus Eradication (SAVE) Our Poultry Act that is intended to elevate the standard of biosecurity and to encourage research into protection including immunization.

In announcing the proposed legislation, Rep. McBride stated, “The SAVE Our Poultry Act is about supporting our farmers and their efforts to protect their animals, their markets and their future.” According to an April 10th release by Rep. McBride, the intended legislation would:

- Authorize USDA research grants to study highly pathogenic avian influenza

- Analyze the impact of poultry vaccination on international trade and market access

- Fund enhanced biosecurity practices and disinfection methods for poultry producers

The press release justifiably notes the high prices for eggs as a result of depopulation of flocks and pointed to the support by the National Chicken Council (NCC) representing broiler producers, the United Egg Producers and regional poultry associations with members at risk of or having experienced losses as result of HPAI. Specifics of the Bill that would amend the Food, Agriculture, Conservation and Trade Act of 1990 emphasizes HPAI as a “high priority research and extension area”.

Among other components the bill makes provision for grants to colleges and universities to “research the effectiveness of vaccines across poultry species, improve formulations of vaccines and improve the delivery mechanisms for vaccines. This is in itself commendable but ignores the reality that both subunit vector vaccines are available off-the-shelf together with inactivated oil emulsion products that could be deployed immediately following approval and authorization for use by USDA-APHIS. Ongoing research is obviously beneficial, but the infection is expected to return within months and research envisaged in the SAVE Our Poultry Act would do nothing to reduce losses in 2025 through 2026.

A provision of the bill goes to the core of the disinclination by USDA to allow vaccination. The SAVE Our Poultry Act would involve “assessing the potential implications of vaccination on domestic and international poultry markets including trade and market access considerations.” It is evident that the broiler segment of the U.S. poultry industry through its lobbying and the influential Broiler Caucus has effectively prevented the application of vaccination to the detriment of the turkey and egg production segments irrespective of sentiments expressed by the NCC.

A provision of the bill goes to the core of the disinclination by USDA to allow vaccination. The SAVE Our Poultry Act would involve “assessing the potential implications of vaccination on domestic and international poultry markets including trade and market access considerations.” It is evident that the broiler segment of the U.S. poultry industry through its lobbying and the influential Broiler Caucus has effectively prevented the application of vaccination to the detriment of the turkey and egg production segments irrespective of sentiments expressed by the NCC.

Congressional Response to the Secretary of the Department of Health and Human Services

The poultry industry and human epidemiologists should be alarmed by the misinformed, and incendiary statements by Robert F. Kennedy, Jr. Secretary of the Department of Health and Human Services as reported in the New York Times on March 18th, relating to “letting avian flu run through flocks so we can identify the birds and preserve those that are immune to it.” This appalling approach to end the bird flu epidemic is unworthy of even cursory consideration.

Five members of the House of Representatives addressed a letter to the Secretary on April 1st condemning his statement and demanding reports and copies of communications among the Department of Health and Human Services, the USDA, the Centers for Disease Control and Prevention and the National Institutes of Health regarding mitigation of avian influenza.

Five members of the House of Representatives addressed a letter to the Secretary on April 1st condemning his statement and demanding reports and copies of communications among the Department of Health and Human Services, the USDA, the Centers for Disease Control and Prevention and the National Institutes of Health regarding mitigation of avian influenza.

In the first instance it is noted that avian influenza will ultimately kill in excess of 98 percent of an infected flock. During the clinical phase, vast quantities of virus are generated resulting in the potential for inter-farm spread especially where complexes are located in close proximity. Even if a small proportion of a flock were to survive an outbreak of avian influenza their value for breeding would be negligible given that the commercial generation of broiler, turkey and egg-production flocks are hybrids. The program of “stamping-out” has in all probability reduced farm-to-farm spread notwithstanding the depopulation of 170 million commercial poultry since the onset of the 2022 epornitic.

To add insult to injury, the Secretary of Agriculture, Brooke Rollins apparently embraced the distorted logic expressed by Secretary Kennedy despite confusingly advancing a “four-pronged strategy” incorporating nothing new and funded by a proposed $1 billion in an attempt to suppress HPAI.

To add insult to injury, the Secretary of Agriculture, Brooke Rollins apparently embraced the distorted logic expressed by Secretary Kennedy despite confusingly advancing a “four-pronged strategy” incorporating nothing new and funded by a proposed $1 billion in an attempt to suppress HPAI.

The five members of the House, including Rep. Raja Krishnamoorthi (D-IL), Ranking Member of the Subcommittee on Healthcare and Financial Services and Rep. Gerald E. Connoly (D-VA), Ranking Member of the Committee on Oversight and Government Reform requested a list of non-governmental experts consulted by HHS relating to any federal response to avian influenza. The Representatives also requested “a full and complete list of individuals who recommended that the federal government would allow avian flu to run through the flock in an effort to build immunity” together with their credentials and past involvement with the federal government. The letter to Secretary Kennedy raised the justifiable issue of a potential zoonotic infection and stressed the need to “combat, contain and eliminate avian influenza, requiring a concerted and coordinated effort across all relevant federal agencies.”

Secretary Kennedy is devoid of scientific credentials. He has surrounded himself with sophists and charlatans expressing unconventional policies to prevent human infections. He has embraced conspiracy theories on disease and related topics that have been debunked by both U.S. and international scientist and agencies. As a Secretary of the HHS he is entitled to his personal opinions but not a selective or distorted expression of facts

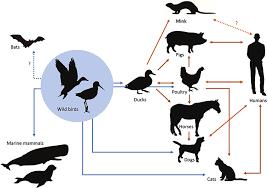

Zoonotic Implications of HPAI

The zoonotic aspect of HPAI was reviewed in a published interview prepared by Dr. Eric Rubin Editor-in-Chief and Dr. Lindsey Baden, Deputy Editor of the New England Journal of Medicine who discussed infectivity of HPAI with virologist Dr. Yoshihiro Kawaoka. Of concern is the circulation of H5N1 genotype D.11 and B3.13 in avian species and dairy herds respectively. Although the incidence rate of bovine influenza H5N1 is declining more than 1,000 herds have been diagnosed with possibly many more infected. Both structural deficiencies and a lack of effective biosecurity within the U.S. dairy industry have contributed to dissemination of the virus. It does not help that the Administration has terminated personnel involved in response to COVID and have effectively disbanded the group of scientists including epidemiologists, virologists and logisticians concerned with preparedness for a future pandemic. Signing a Presidential Executive Order has transitory political effect but does not necessarily prevent the inevitable emergence of an infection with epidemic or pandemic potential at some time in the future.

Rubin, E. et al outbreak update-H5N1 New England Journal of Medicine 2025 doi.org/10.1056/nejme 2502267

Aerogenous Transmission of H5N1 Confirmed

EGG-NEWS has consistently maintained that highly pathogenic avian influenza (HPAI) can be transmitted by the aerogenous route either as a bioaerosol or entrained on excreta and dust to be moved by wind. A comprehensive epidemiologic investigation involving field observations, meteorology and molecular studies confirmed the spread of an outbreak of H5N1 from a commercial duck farm to unrelated egg production farms over a distance of five miles. The case report with appropriate documentation involved an outbreak in the Czech Republic. The authors note that their findings “underscore the importance of considering windborne spread in future outbreak mitigation strategies.” Anecdotal and experimental data confirm the possibility of airborne infection extending from waterfowl excreting virus.

The USDA-APHIS has long held that “biosecurity of an acceptable standard will provide protection against HPAI.” This is a false presumption given the ability of the virus to be transmitted over relatively long distances by the aerogenous route. As noted by the authors of the Czech paper, power-ventilated egg production housing is extremely vulnerable given the volume of air displaced by fans. Exhaust rates may range from 200,000 to 600,000 cfm per 100,000 hens depending on climatic conditions. Among the many failures of USDA-APHIS to address appropriate preventive measures has been a neglect of field epidemiology. The only conclusions that can be drawn from superficial telephone-administered surveys is that proximity to waterfowl preceding an outbreak was a significant risk factor. This would indirectly correspond with the observations in this significant publication.

Nagy, A. et al bioRxiv doi.org/10.1101/2025.02.12.637829

Editorial Comment

The Economic Impact of HPAI

There is no purpose in tiptoeing around the failure to adopt vaccination against HPAI in high-risk areas. The broiler industry may or may not lose a part of their market for leg quarters that represent over 97 percent of shipments of USDA-inspected broiler products valued at $4.5 billion in 2024. Although this restraint is significant in terms of volume and monetary value, the ban on vaccination requires a broader perspective. The USDA-APHIS has expended over $2 billion in indemnity payments and logistics from the Commodity Credit Corporation. Individual egg producers have experienced disproportionately higher losses as a result of their inability to supply markets during the period required to repopulate their complexes. Consumers have been forced to pay high prices for eggs, far exceeding the potential loss that may be experienced through export markets. In 2022, the average price of eggs was conservatively $2 per dozen higher than it would have been in the absence of HPAI, costing consumers an incremental $15 billion on their grocery expenditures. In 2024 the cost to consumers as a result of HPAI was infinitely higher given the differential between average shelf price and values that would otherwise have prevailed. The loss of 30 million hens during the first two months of 2025 was reflected in an escalation in egg prices peaking at $8.58 per dozen at wholesale on February 28th but declining thereafter to $3.27 per dozen by the end of March. Notwithstanding this decline, the escalation in egg prices attained 60.4 percent in March 2025 compared to twelve months previously. The disproportionate escalation in the price of eggs should be compared to an increase of 0.5 percent for food-at-home during March. Within this category, dairy items increased by 2.2 percent, poultry meat by 0.9 percent, cereal and bakery products by 1.1 percent. Fruit and vegetables declined by 0.7 percent. and the fish and seafood category was down by 1.5 percent.

|

|

In reviewing the export market for broiler leg quarters, it is noted that volumes are declining but unit prices are moving in the opposite direction although with a net decline in total annual value. The question arises as to whether importing nations would continue to purchase leg quarters if preventive vaccination were to be permitted for egg-production flocks in high-risk areas. Vaccination would be subject to appropriate monitoring and surveillance in accordance with World Organization of Animal Health (WOAH) or negotiated standards. It is envisaged that USDA-APHIS could certify that broiler flocks of origin contributing to exports were free of HPAI at the time of slaughter. It is also important to note that many of the nations importing U.S. leg quarters do so on the basis of low cost with an average unit price of $1,424 prevailing over the first two months of 2025 covering 479,000 metric tons. Many importing nations are endemic with respect to HPAI and in some cases deploy vaccines against the infection. This would facilitate exports in accordance with the rules of the WOAH.

The USDA-APHIS has been stubbornly remiss in their failure to negotiate terms under which U.S. producers could justifiably export broiler leg quarters from non-infected flocks. For more than three years the Agency has labored under the misplaced presumption that HPAI is exotic in the U.S. and that the disease could be eradicated following an anachronistic “stamping-out” program. The fallacy in the APHIS playbook is the failure to accept that infection is disseminated by millions of wild bird reservoirs on a seasonal basis together with introduction by migratory marine birds cohabitating with waterfowl in the Canadian Maritime provinces and in Alaska with extension down into British Colombia.

For the edification of APHIS there is adequate anecdotal and scientific evidence of introduction of infection on to farms by the aerogenous route. This reality means that even the strictest biosecurity does not provide absolute protection against H5N1 and other highly pathogenic avian influenza viruses suggesting a phased shift in the approach to vaccination.

Reducing the Capacity of the U.S to Respond to Zoonotic HPAI

The ongoing mass dismissals in the U.S. Food and Drug Administration will have an adverse effect on testing consumer dairy products although it is generally accepted that pasteurization inactivates bovine influenza H5N1 strain B3-13 virus. Similar reductions in staffing at the Centers for Disease  Control and Prevention will compromise detection of possible zoonotic infection that appears to be increasing in complexity and significance. Mass layoffs have affected 40 cooperating laboratories within the FDA Veterinary, Laboratory Investigation and Response Network and also the USDA National Animal Health Laboratory Network responsible for aspects of routine and diagnostic activities. Critical reductions have occurred among the personnel of the National Animal Health Laboratory Network that coordinates activities between the USDA National Veterinary Services Laboratory and the approximately 60 state and university laboratories throughout the U.S. This commentator gives little credence to a USDA spokesperson that averred that job reduction “will not compromise the critical work of the department including its ongoing response to avian influenza.”

Control and Prevention will compromise detection of possible zoonotic infection that appears to be increasing in complexity and significance. Mass layoffs have affected 40 cooperating laboratories within the FDA Veterinary, Laboratory Investigation and Response Network and also the USDA National Animal Health Laboratory Network responsible for aspects of routine and diagnostic activities. Critical reductions have occurred among the personnel of the National Animal Health Laboratory Network that coordinates activities between the USDA National Veterinary Services Laboratory and the approximately 60 state and university laboratories throughout the U.S. This commentator gives little credence to a USDA spokesperson that averred that job reduction “will not compromise the critical work of the department including its ongoing response to avian influenza.”

Stop Press: 60-Minutes Segment on HPAI

The 60-Minutes airing on April 20th focused on bovine influenza H5N1 with little coverage of HPAI in poultry other than the obvious impact on egg prices. The greatest deficiency was a lack of ‘assurance’ that avian influenza is not transmissible to consumers through eggs. APHIS was disinclined either through governmental restraint or lack of photogenic administrators, from participation in the program.

The Bottom Line

It is hoped that well-intended Congressional action, comments by informed commentators and scientific publications will break the de facto veto exercised by the broiler sector over vaccination as a modality to suppress outbreaks of HPAI in turkey and egg-producing flocks. Further temporizing proposed in the form of additional “discussion” and “research” is disingenuous. Delay will be both costly and represent a risk of emergence of a potentially zoonotic strain. The Administration should sincerely work towards reducing the price of eggs over the long term, limit public sector expenditures on control and avoid even the smallest risk of a catastrophic pandemic. Those in authority in the USDA and DHHS would be well advised to heed the advice of epidemiologists, avian health practitioners, the WOAH and informed observers regarding the efficacy and desirability of vaccination to establish immune populations with appropriate surveillance in high-risk areas.