Circana recently published the results of a consumer survey relating to acceptance of pork from genetically modified hogs. The study comprised 5,000 subjects from eight industrialized nations with a questionably high response rate of 96 percent. In this case, consumers were requested to provide an opinion as to whether they would purchase pork from genetically modified hogs, thereby reducing potential antibiotic use. Overwhelmingly (94 percent) of consumers were willing to purchase pork from gene-edited hogs with a proviso that the process would offer tangible benefits to consumers and that appropriate transparency including packaging would be maintained. This said, interpretation of survey results are highly dependent on the framing of questions and selection of participants.

The study presumably relates to the biotechnology introduced by UK-based Genus plc. This company pioneered deletion of the CD163 gene by applying CRISPR to produce piglets resistant to porcine reproductive and respiratory syndrome (PRRS). Genus plc has applied to the U.S. Food and Drug Administration for approval of the gene-deleted strain of hogs since CRISPR is regarded inexplicably by FDA bureaucrats as an “investigational new drug”. It is anticipated that the Agency will expedite approval since CRISPR involves deletion of genetic material not involving insertion of novel genes. It is noted that acceptance of genetically modified salmon by the FDA required decades before the Aqua Bounty® strain of salmon was approved since the technology involved introduction of genes from other salmon and marine species.

The response of potential consumers to the hog study has relevance to possible gene modification of chickens to enhance growth and livability and in the short term for gender sorting of egg-production strains. NRS Poultry Sustainability and Transformation Inc. in association with scientists at the Volcani Institute in Israel has developed a unique genetic approach to identifying and eliminating cockerel chicks. Dr. Yuval Cinnamon affiliated to the Institute and founder of NextHen has promoted the ‘Golda’ approach to eliminating male embryos in-ovo.

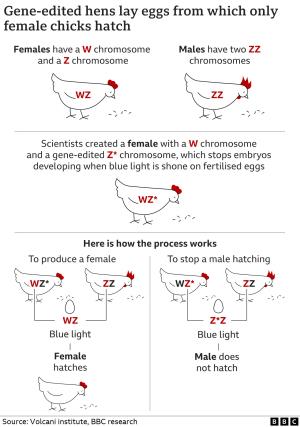

The technique involves application of CRISPR-CAS9 to a sequence of the z chromosome, a co-determinant of gender in chickens. Males carry the zz chromosome and females are zw. The construct developed by NRS with intended commercialization by NextHen requires insertion of promoters adjacent to the 5’HA end of the sequence and insertion of a lethal gene adjacent to the 3’HA end. Lethality is activated by exposure to light of a highly specific blue wavelength. The construct must be inserted into the pure line C strain to pass the altered z chromosome to the grandparent C-line hen. The female of the parent level (CD) will therefore carry the modified z chromosome. The male line AB parents are normal in all respects. At the parent level CD females carrying the modified z chromosome mated to AB males produce pullet chicks with a normal z and w chromosomes. Eggs from the mating are subjected to blue light that is optogenic in its action on the z chromosome carrying the lethal gene. This results in inhibition of development of male (zz) embryos since they carry the lethal trait on the z chromosome acquired from the CD parent female (zw). Female embryos carry an unaltered z chromosome and therefore hatch normally.

The NRS/NextHen approach to eliminating male chicks is elegant, based on establish scientific principles and offers advantages with respect to cost, practicality and rate of implementation.

Despite the obvious advantages, primary breeders have demonstrated no inclination to adopt the system and have instead applied currently available alternatives to identify eggs bearing male embryos.

From a scientific perspective, commercial pullet chicks are not genetically modified, but the system relies on insertion of a construct into the pure C line. There is obvious concern that opponents of intensive livestock production will cite the application of genetic modification to demonize not only the specific Golda hen but will extended deprecation to all commercial egg production. Neither of the two leading primary breeders wishes to be first to adopt the technology given the “tainted GMO association.” For the NRS/Volcani/NextHen technology to become a reality, it will be necessary to confirm that consumers will accept the highly technical assurance that the commercial level chick is not genetically modified. In the case of the Genus PRRS-resistant hog the technology involved deletion of a gene applying CRISPR. The survey revealed that approximately half of U.S. consumers evidently are aware of gene editing.

It is possible that China may adopt the technology given their volume of production and with Governmental support of GMO, justifying application. China is rapidly developing pure lines and has aspirations to be independent of major primary breeders located in the E.U. and the U.S. for domestic needs and export.

There is no obvious benefit to consumers from applying the genetic approach to eliminating cockerels given that non-GMO alternatives are commercially available and are currently in use.

For the NR technology to become a practical reality the first hurdle will be for one or more of the primary breeders to enter into a strategic alliance with the developers and incorporate the z chromosome construct into the pure C line. The second challenge will be to convince consumers and regulators that the pullet chicks are effectively non-GMO. Since the issues are interwined the commercialization of the GM technology is an example of the “chicken-or-the-egg” paradox.

Editor’s Comment:

The GM approach to in-ovo elimination of cockerels was reviewed in the November 18th 2021 edition of EGG-NEWS. The fact that there has been no commercial adoption of the technology in more than four years suggests that acceptance of the genetic approach is highly unlikely, notwithstanding its potential.