REVIEW OF OCTOBER 2022 EGG PRODUCTION COSTS AND STATISTICS.

OCTOBER HIGHLIGHTS

OCTOBER HIGHLIGHTS

- October 2022 USDA ex-farm blended USDA nest-run benchmark price was 284.4 cents per dozen, 5.4 percent higher than the September 2022 value of 269.8 cents per dozen. For comparison average USDA benchmark price for 2021 was 84.3 cents per dozen with a range of 58.0 cents per dozen in June to a high of 123.6 in December. Stock levels and prices prior to the onset of flock depletion due to HPAI indicated a relative seasonal balance between supply and demand. Prevailing wholesale prices will be largely dependent on consumer demand in an inflationary environment, with the potential to impact retail sales and margins. Other considerations include diversion to shell sales from the egg-breaking sector and fluctuation attributed to the amplification of changes in unit wholesale revenue due to the price discovery system. A moderate decline from unseasonal current levels is anticipated into early 2023 unless additional depletion of flocks occurs due to HPAI.

- October 2022 USDA average nest-run production cost was down 1.4 cent per dozen (1.7 percent) compared to September 2022 to 80.0 cents per dozen, mainly attributable to a 2.4 percent lower average feed cost per dozen.

- October 2022 USDA benchmark nest-run margin attained a positive value of 204.4 cents per dozen compared to a margin of 188.4 cents per dozen for September 2022.

- September 2022 national flock in production (over 30,000 hens/farm) was up 0.8 percent or 2.3 million hens to 290.2 over a revised August 2022 value of 287.9 million. Approximately 2.5 million hens returned to production from molt in early September together with projected maturation of 24.0 million pullets, with this number offset by depletion of spent flocks. From February through the beginning of November, approximately 38 million hens were depopulated to control HPAI.

- September 2022 pullet chick hatch was up 5.3 percent or 1.4 million from August 2022 to 26.6 million.

- September 2022 exports of shell eggs and products combined were up 14.0 percent from a low volume in August 2022 to 413,000 case equivalents representing the theoretical production of 5.9 million hens.

INTRODUCTION.

INTRODUCTION.

Summary tables for the latest USDA October 2022 prices and flock statistics made available by the EIC on November 11th 2022 are arranged, summarized, tabulated and reviewed in comparison with values from the previous October 7th 2022 posting reflecting September 2022 costs and production data.

COSTS & REVENUE

|

Parameter

|

SEPTEMBER 2022

|

OCTOBER 2022

|

|

5-Region Cost of Production ex farm (1st Cycle)1

|

81.4 c/doz

|

80.0 c/doz

|

|

Low

|

77.9c/doz (MW)

|

76.1 c/doz (MW)

|

|

High

|

88.5 c/doz (N.West)

|

87.8c/doz (N.West)

|

Components of USDA 6-Region 1stCycle nest-run Cost of Production:-

Note: 1. Rounded to decimal of a cent

| |

SEPTEMBER 2022

|

OCTOBER 2022

|

|

Feed

|

50.5 c/doz

|

49.3c/doz

|

|

Pullet depreciation

|

13.6 c/doz

|

13.5 c/doz

|

|

Labor (estimate)

|

4.0 c/doz

|

4.0 c/doz

|

|

Housing (estimate)

|

5.0 c/doz

|

5.0 c/doz

|

|

Miscellaneous and other*

|

8.3 c/doz

|

8.2 c/doz

|

* Adjusted January 2022 and used as a rounding factor

Ex Farm Margin (rounded to nearest cent) according to USDA values reflecting October 2022:-

284.4 cents per dozen1- 80.0 cents per dozen = +204.4 cents per dozen (September 2022 comparison: 269.8 cents per dozen – 81.4 cents per dozen = +188.4 cents per dozen.)

Note 1: USDA Blended egg price

| |

|

SEPTEMBER 2022

|

OCTOBER 2022

|

|

USDA

|

Ex-farm Price (Large, White)

|

269.8 c/doz (Sep.)

|

284.4 c/doz (Oct.)

|

| |

Cage-free to packing plant1

|

335.0 c/doz (Sep.)

|

393.0 c/doz (Oct.)

|

| |

Warehouse/Dist. Center

|

277.0 c/doz (Sep.)

|

339.0 c/doz (Oct.)

|

| |

Store delivered (estimate)

|

282.0 c/doz (Sep.)

|

344.0 c/doz (Oct.)

|

| |

Dept. Commerce Retail

|

311.6 c/doz (Aug.)

|

290.2 c/doz (Sep.)

|

- Negotiated price nest run loose

MONTH SEPTEMBER 2022 OCTOBER 2022

U.S. Average Feed Cost per ton $317.54 $309.82

Low Cost Midwest $297.99 $287.94

High Cost Northwest $357.24 $353.28

Differential $ 59.25 $ 75.34

Pullet Cost*

(19 Weeks) $5.11 SEPTEMBER 2022 $5.05 OCTOBER 2022

(16 weeks) $4.42 SEPTEMBER 2022 $4.38 OCTOBER 2022

* Values adjusted by EIC in February 2022

VOLUMES OF PRODUCTION

|

PARAMETER

|

SEPTEMBER 2022

|

OCTOBER 2022

|

|

Table-egg strain eggs in incubators

|

49.2 million (Sep.)

|

47.9 million (Oct.)

|

|

Pullet chicks hatched

|

28.0 million (Sep.)

|

26.6 million (Oct.)

|

|

Pullets to be housed 5 months after hatch

|

25.3 million (Jan. ‘23)

|

22.4 million (Feb. ‘23)

|

|

2022 December 1st Flock Projection

|

317.3 million

|

318.0 million

|

|

National Flock in farms over 30,000 (2022)

|

287.9 million (Aug.)

|

290.2 million (Sep.)

|

|

National egg-producing flock (2022)

|

304.7 million (Aug.)

|

307.0 million (Sep.)

|

|

Cage-free flock excluding organic

|

87.0 million (Sep.)

|

88.8 million (Oct.)

|

|

Proportion of flocks in molt or post-molt

|

13.2% (Sep.)

|

13.4% (Oct.)

|

|

Total of hens in flocks over 30,000, 1st cycle (estimate)

|

249.8 million (Aug.)

|

252.0 million (Sep.)

|

|

Total U.S. Eggs produced (billion)

|

7.78 (Aug.)

|

7.56 (Sep.)

|

|

Total Cage-Free hens in production

|

105.0 million (Aug.)

17.1% Organic

|

106.8 million (Sep.)

16.9% Organic

|

|

“Top-5” States hen population (USDA)1

|

143.4 million (Aug.)

|

144.7 million (Sep.)

|

Notes 1. Texas excluded to maintain confidentiality

PROPORTION OF U.S. TOTAL HENS BY STATE, 20221

Based on a nominal denominator of 288 million hens in flocks over 30,000 covering 95.0 percent of the U.S complement.

USDA has amended inclusion of specific states in regions and eliminated Texas data to protect confidentiality of Company flock

Sizes

|

STATE

|

AUGUST

2022

|

SEPTEMBER

2022

|

|

|

Iowa

|

12.9%

|

13.3%

|

|

|

Indiana

|

12.4%

|

12.3%

|

|

|

Ohio

|

12.3%

|

12.1%

|

|

|

Pennsylvania

|

7.8%

|

7.6%

|

|

|

Texas (estimate)

|

6.8% ?

|

6.7% ?

|

|

|

California

|

4.5%

|

4.5%

|

|

- Values rounded to 0.1%

Rate of Lay, weighted hen-week (USDA) 82.4% SEPTEMBER 2022. 81.8% OCTOBER 2022

Actual per capita egg consumption 2016:- 275.3 (up 19.8 eggs from 2015, HPAI )

Actual per capita egg consumption 2017:- 282.1 (up 6.8 eggs from 2016)

Actual per capita egg consumption 2018:- 287.8 (up 5.7 eggs from 2017)

Revised per capita egg consumption 2019:- 293.4 (up 5.6 eggs from 2018)

Revised per capita egg consumption 2020:- 285.4 (down 8.0 eggs from 2019)*

Estimated per capita egg consumption 2021:- 280.5 (down 4.9 eggs from 2020)*

Projected per capita egg consumption 2022:- 278.3 (down 2.2 eggs from 2021 due to HPAI) Forecast per capita egg consumption 2023:- 292.4 (up 14.1 eggs from 2022)

*Revised, using data from USDA Livestock, Dairy and Poultry Outlook October 18th 2022 taking into account the decreased demand from the food service sector and including an effect from HPAI depopulation.

Egg Inventories at beginning of OCTOBER 2022:

Shell Eggs: 1.50 million cases down 9.6 percent from September 2022.

Frozen Egg Products: 687,199 case equivalents up 3.7 percent from September 2022

Dried Egg Products: Not disclosed since March 2020. Assume moderate level of inventory

Eggs broken under FSIS inspection (million cases)

AUGUST 2022, 6.88 SEPTEMBER 2022, 6.47

Cumulative eggs broken under FSIS inspection 2021 (million cases) 76.2 JAN. to DEC.

Cumulative 2021: number of cases produced (million) 268.7 JAN. to DEC.

Cumulative 2021: proportion of total eggs broken 28.3% (30.1% 2020)

Cumulative 2022: number of cases produced (million) 192.6 JAN. to SEP.

Cumulative 2022: proportion of total eggs broken 30.8 %

EXPORTS SEPTEMBER 2022: (Expressed as shell-equivalent cases of 360 eggs).

|

Parameter

|

Quantity Exported

|

|

Exports:

|

2022

|

|

Shell Eggs (thousand cases)

|

AUG. 166 SEP. 204

|

|

Products (thousand case equivalents)

|

AUG. 196 SEP. 209

|

|

TOTAL (thousand case equivalents)*

|

AUG. 362 SEP. 413

|

*Representing 2.0 percent of National production in September 2022.

COMMENTARY ON OCTOBER 2022 COSTS AND STATISTICS

COST AND REVENUE DATA FOR OCTOBER 2022

The USDA reports data for five regions, respectively comprising the Northeast, South East (Mid-Atlantic), South Central, Midwest, and Northwest (NW and California combined in some tables).

From March 2019 onward some state data was withheld to maintain confidentiality where a company predominates in a specific state or region. From March 2021 California costs were inexplicably excluded, representing an unjustified concealment of data. The three Pacific Coast states could be combined to maintain confidentiality while providing representative U.S. data. Costs including feed and depreciation were recalculated in January 2022.

- The USDA ex farm benchmark blended egg price in October 2022 was 5.4 percent higher or 14.6 cents per dozen up from September 2022 to 284.4 cents per dozen. This contributed to a positive margin of 204.4 cents per dozen based on ‘nest-run’ eggs (delivered from the laying house) in October 2022, compared to a positive margin of 188.4 cents per dozen in September 2022. The October 2022 USDA benchmark price of 284.4 cents per dozen should be compared to 85.6 cents per dozen for the corresponding month in 2020 and 77.7 cents per dozen in October 2021. The relatively high values during the first and second quarters of 2022 compared to corresponding months for the two previous years were due to depletion of hens following the emergence of HPAI coupled with a rise in demand following relaxation of COVID restrictions.

- During October 2022, the feed component of production cost averaged 49.3 cents per dozen, down 2.4 percent or 1.2 cents per dozen from September 2022. Over 2021 average feed cost was 42.5 cents per dozen compared to 31.7 cents per dozen in 2020.

- Combining data from the USDA and the EIC, producers recorded a positive margin of 204.4 cents per dozen at farm-level for generic-egg flocks during October 2022. This compares with a positive margin of 188.4 cents per dozen in September 2022. For 2021 the cumulative average algebraic margin was 91.0 cents per dozen; for 2020, 16.0 cents; for 2019, -2.8 cents and for 2018, 35.3 cents per dozen, against USDA benchmark ‘nest run’ values. During the ten months of 2022 cumulative algebraic margin attained 1,268 cents per dozen.

- The simple average price of feed in October 2022 over 5-regions was $309.82 per ton, $7.72 per ton or 2.4 percent lower (using revised monthly USDA-AMS data) compared to September 2022. Southwest data is no longer disclosed to avoid compromising a company that predominates in Texas. The highest cost among five regions was the Northwest at $353.28 per ton, down 1.1 percent from September. This may be compared to the lowest-cost region, the Midwest at $287.94 per ton, down 3.4 from the previous month. The average cost value for feed includes ingredients plus milling and delivery at a nominal $10 per ton.

- The benchmark price of corn was $262.29 per ton in October 2022, down $0.79 per ton or 0.3 percent from the September 2022 price, taking into account the difference in basis paid by producers. The differential in corn price between the Midwest and the Northwest in October 2022 was $68.11 per ton. A 6.6 percent decrease of $31.83 per ton in the price of soybean meal to $450.34 per ton in October added to the slightly lower price of corn. The industry has experienced sharp increases in the cost of phosphate additives, fat and vitamins since March. During October 2022 there was a differential of $82.35 per ton in feed price between the Midwest and the Northwest compared to a difference of $59.25 per ton in September 2022.

- Feed price will continue to be a major factor driving production cost and hence margin. WASDE #630 released on November 9th projected the volumes of the 2022 corn and soybean harvests, ingredient use, exports and ending stocks for the two commodities. Unknown factors influencing feed cost during the fourth quarter will include the consequences of the invasion of Ukraine with inevitable disruption in production and shipping from the region. This influence coupled with the results of the drought in the Midwest that reduced corn yield will affect prevailing prices in international trade. The availability and hence prices of ingredients will also be influenced by weather conditions as influenced by the persistent La Nina, the export volume from the U.S. and especially to China, diversion of corn to ethanol combined with the remaining economic and logistic effects of COVID restrictions and inflation. There is obviously low demand for ethanol with production at the one-million barrel per day benchmark for five successive weeks after a succession of weeks with lower production. Substantial exports of corn and soybeans to China, in market year 2022/2023 has increased domestic price and hence cost of egg production. Each $10 per ton difference in feed cost represents approximately 1.70 cents per dozen. A change of $1 per ton (2.8 cents per bushel) in the price of corn is reflected in a 0.11 cent per dozen difference in production cost. A $10 per ton change in the price of soybean meal affects production cost by 0.35 cent per dozen.

- The EIC calculated the 5-Region total nest-run production cost in September 2022 to be 80.0 cents per dozen, 1.4 cents per dozen or 1.7 percent lower than in September 2022. Production costs during October 2022 ranged from 76.1 cents per dozen in the Midwest up to 87.8 cents per dozen in the Northwest, higher than the Midwest region by 11.7 cents per dozen.

Deletion of California data is considered a substantial deficiency of the EIC Report.

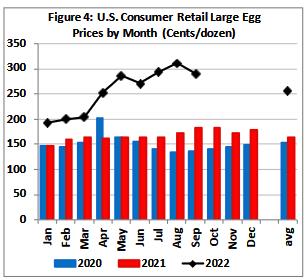

- Retail egg prices as determined by the Department of Commerce for September 2022 averaged 290.2 cents per dozen, down 21.4 cents per dozen from August 2022. During September 2020 and 2021 retail prices were respectively 135.3 and 138.5 cents per dozen. Consistently since 2017 average retail prices have not declined in proportion to ex-farm prices, allowing higher margins at retail, thereby depressing demand. Retailers have recently demonstrated some restraint in pricing possibly due to competition from deep discounters and club stores, despite sustained demand.

PRODUCTION DATA FOR OCTOBER 2022

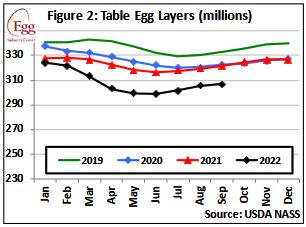

- According to USDA, the estimated average complement of U.S. hens in flocks over 30,000 during September 2022 amounted to 290.2 million, reflecting a net increase in flock size by 1.6 million hens during the month. Routine depletion and also depopulation due to HPAI was partly offset by pullet replacements and retained flocks. The average total U.S. flock including hens in molt on all farms counted by the USDA amounted to 307.0 million in September 2022. This value will be adjusted subsequently following an accounting of depopulation and replacement. The average end-of-year flock sizes over the past seven years respectively were, 2014, (311 million); 2015, (291 million post-HPAI losses); 2016, (319 million); 2017, (329.6 million); 2018, (341.6 million); 2019, (341.6 million) and 2020, (325.5 million). The December 1st 2022 flock was projected to be 318.0. This figure is depressed by flock depopulation amounting to 38 million hens through mid-November. In the absence of a vaccine only effective biosecurity will protect flocks during the remainder of 2022.

- The effect of COVID restrictions on the egg-breaking segment of the industry is noted in the decline in the flock size in Iowa during 2020. In January of that year the state had 56.4 million hens with a progressive reduction following a collapse of the egg-liquid market. Hen population in Iowa stabilized at 46.9 million by May 2021 rising to 47.3 million in August 2021 but falling to 44.3 million in February 2022. The hen population was 21.2 percent lower (11.0 million hens) than the pre-COVID level. The decline in the population of hens in Iowa was accentuated by depopulation of 12.7 million in March to control outbreaks of HPAI. As of the end of September 2022 Iowa housed 38.1 million hens according to USDA figures. Subsequently approximately 2 million hens were depopulated in early November following outbreaks of HPAI on two Wright County complexes.

- Pullet chick hatch attained 26.6 million in September 2022, down 1.4 million from August 2022. It is anticipated that seasonal prices will be higher than for preceding years through the remainder of 2022, resulting in demand for chicks for expansion in addition to necessary replacement of depleted pullets and hens. It is understood that production of additional pullet chicks is unlikely given forward planning by breeder-hatcheries and full utilization of facilities

- The total in-molt and post-molt population of hens in the 5-Regions monitored by the USDA attained 13.1 percent of the national flock in October 2022, compared to 13.1 percent in September 2022. Annual averages for molt and post-molt combined were 14.4 percent in 2021, 13.5 percent for 2020, 15.2 percent for 2019 and 17.4 percent for 2018. The historical high value of 23.8 percent in 2016 was due to the loss of hens during the 2015 HPAI epornitic. This situation will be revisited in 2022 and 2023.

- During the first quarter of 2022 the average monthly transfer of pullets to laying houses was 21.3 million followed by 21.1 million in the second quarter and 25.1 million in the third quarter. The projected transfer for the fourth quarter of 2022 is projected at 24.7 million pullets per month.

- The projected hatchery supply flock (parent generation) peaked during 2022 at 3.1 million hens in June. The previous peak parent-flock of 3.1 million hens in production was in June 2015, coinciding with the end of the HPAI epornitic. Parent hens then declined to a low of 2.5 million during the fourth quarter of 2016. Parent flocks attained a monthly average of 3.1 million during the second quarter and 2.9 million for the third quarter of 2022. The projected flock size for the fourth quarter of 2022 is projected at 2.8 million hens. The size of the parent flock is unlikely to be revised based on pullet chick orders influenced by the demand to replace depopulated hens and in response to higher producer margins.

- Average hen-week production of 81.8 percent in October 2022 compared to a revised value of 82.2 percent in September 2022 reflects a slightly lower proportion of younger hens in the national flock with many first-cycle hens and early second-cycle hens in production. Average rate of lay in 2021 was 82.0 percent, with 80.9 percent in 2020 and compared to 79.2 percent during 2019. The average rate of lay during any period is a function of the proportion of pullets placed, the rate of depletion of flocks and retention of molted hens for a second cycle. Average flock production will fall as the weighted flock age increases or conversely will rise due to early depletion thereby increasing the proportion of young hens in their first cycle.

- The October 24th 2022 USDA Poultry Slaughter Report documented 2.8 million light spent-hens processed under FSIS inspection during September 2022, 9.7 percent more than the previous month and 3.3 percent more than in September 2021. These increases are inconsequential in comparison to the depletion of 14 million hens per month with the bulk either rendered or consigned to landfills. Provided housing space is available, prevailing high prices will result in retention of hens with fewer routine or previously scheduled flock depletions.

EXPORT DATA FOR SEPTEMBER 2022.

- Monthly export data can be accessed in the relevant report retrievable under the STATISTICS Tab.

- According to USDA-FAS data, 204,000 cases of shell eggs were exported in September 2022, representing 1.0 percent of total production. The 22.9 percent increase over a small base in August 2022 is attributed to demand from Canada.

- Exports of egg products in September 2022 attained 209,000 case-equivalents, representing 1.0 percent of U.S. output.

- Collectively, exports of shell eggs and products in September 2022 comprised the output from approximately 5.9 million hens in production during the month, attaining 412,500 case-equivalents, up 14.1 percent from August 2022 but only 69.1 percent of combined exports during the first quarter of 2022 that averaged 596,300 case equivalents per month.

- Maintaining export volume is attributed to cooperation between the AEB and USAPEEC, in existing, new and potential markets. Specific attention is directed to nations with the potential to import U.S. product based on landed price against competition. Exports of both egg-products and shell eggs in September 2022 corresponded to 2.0 percent of a nominal national flock of approximately 310 million hens, (before HPAI depletions) on commercial farms holding more than 30,000 hens.

- There is no scientifically justifiable reason why any nation should embargo pasteurized egg products from an approved plant, based on a diagnoses of avian influenza or END in a state or country.