An unfortunate concordance of high demand through pre-Thanksgiving and Christmas coupled with reduced supply as a result of avian influenza has increased the prices of eggs on the shelf.

An unfortunate concordance of high demand through pre-Thanksgiving and Christmas coupled with reduced supply as a result of avian influenza has increased the prices of eggs on the shelf.

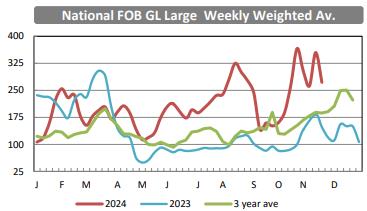

Both local TV stations and print media have commented on higher prices with unfavorable comparisons to the lower per dozen values during the fall of 2023 when flocks had been replenished after previous depopulation due to HPAI.

Year-to-date losses as a result of infection have attained 22 million above routine mortality of 2 million per month and flock depletion of 15 million per month due to age, Replacements through replacement of started pullets are progressing at approximately 22 million per month.

Year-to-date losses as a result of infection have attained 22 million above routine mortality of 2 million per month and flock depletion of 15 million per month due to age, Replacements through replacement of started pullets are progressing at approximately 22 million per month.

The price discovery system used by buyers and the industry accentuates the magnitude of both extreme increases and declines in price. This has been to the detriment of the industry since 2022. The USDA New York price posted each working day is unfortunately related to the commercial benchmark price. A CME quotation for Midwest large would be a more equitable method of establishing price.

Given the incidence rate of HPAI among egg production complexes since the beginning of October and given that migratory waterfowl have not completed their southward movement, additional outbreaks can be anticipated. Avian influenza H5N1 is now regionally and seasonally endemic and accordingly the APHIS policy of attempted “stamping out” of infection is inappropriate. To maintain a complement of 320 million hens in production to satisfy demand with acceptable retail prices for conventional eggs will require vaccination as an adjunct to biosecurity as introduced in the E.U. and long practiced in China and Mexico among other nations with intensive poultry industries. Even the most comprehensive structural and operational biosecurity does not provide absolute protection against aerogenous infection.