In an accusatory article dated May 1st, (below), Joel Dodge implicated price gouging by egg producers and advocated for government intervention in terms of the Defense Production Act. Dodge is Director of Industrial Policy and Economic Security at the Vanderbilt Policy Accelerator and is a contributor to The Hill.

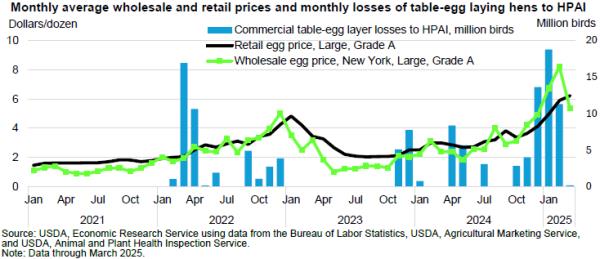

The article implicates Cal-Maine Foods as a major beneficiary of fluctuating and recently high egg prices. This situation can be attributed in large measure to a disequilibrium between supply and demand caused by mandatory flock depopulation following infection with highly pathogenic avian influenza (HPAI) strain H5N1.

To the uninitiated and uninformed, the article makes a strong case for government intervention to prevent egg farmers from profiting from reduction in supply. The article, cites egg prices and comparisons obviously subject to cherry picking and with inadequate evaluation of the mechanism determining wholesale prices.

For the record, the claimed “five-fold increase” in price from 2020 to the high point in retail price during February 2025 was derived from selective comparisons. Dodge quoted a current “average” retail price of $6.23 per dozen without reference to the price in 2020 or indicating his source. It is difficult to establish “average retail” price, especially with a wide range of egg types available and with retail promotions by chains and stores. Accordingly the table below shows high and low wholesale prices for the years 2020 through 2024 and over the first two months of 2025.

|

YEAR

|

LOW WHOLESALE

|

DATE

|

HIGH WHOLESALE

|

DATE

|

|

2020

|

$0.63

|

08/10

|

$2.92

|

03/02

|

|

2021

|

$0.97

|

05/31

|

$1.69

|

12/27

|

|

2022

|

$0.93

|

01/17

|

$4.96

|

12/26

|

|

2023

|

$1.31

|

05/01

|

$5.28

|

01/02

|

|

2024

|

$1.69

|

05/06

|

$5.84

|

05/06

|

|

2025

|

$3.17

|

02/24

|

$8.06

|

04/14

|

It is noted that nest-run (ungraded at farm gate) cost for the past two years averaged $0.75 per dozen for eggs from caged hens and $0.95 per dozen for eggs from hens housed under alternative systems. Given the proportion of cage-free to caged eggs of 40:60 the weighted average nest-run cost over the past two years is approximately $0.85 per dozen. To this figure a provision of $0.65 per dozen should be added to cover packaging, packing and distribution, resulting in a cost of $1.50 as delivered to warehouses. Over periods of high production and with freedom from avian influenza, especially during 2020 through 2022, producers experienced losses against the prevailing prices designated by an industry benchmarking system. Traditionally increases in seasonal demand during the two to four weeks preceding Easter and Christmas was associated with higher prices contributing to positive annual returns.

|

The Dodge article concentrates on Cal-Maine Foods as being responsible for price increases at retail. This company is the only public quoted, essentially pure-play shell egg producer that publishes quarterly reports. These contain detailed production data in addition to the statutory financial disclosures.

For the period Fiscal 2020 through 2024, Cal Maine Foods (CALM) posted net income and diluted earnings per share values as indicated:-

|

YEAR

|

NET INCOME $ million

|

DILUTED EPS

|

|

2020

|

$184.0

|

$ 3.80

|

|

2021

|

$ 2.1

|

$ 0.04

|

|

2022

|

$132.6

|

$ 2.71

|

|

2023

|

$758.0

|

$15.52

|

|

2024

|

$277.9

|

$ 5.70

|

The magnitude of net earnings by Cal-Maine Foods, probably reflecting the industry as a whole, is directly related to the flock losses experienced by the industry as a result of HPAI. These were, respectively:

|

YEAR

|

HENS DEPOPULATED (million)

|

|

2022

|

44

|

|

2023

|

14

|

|

2024

|

40

|

|

2025 (Jan. & Feb.)

|

31

|

Over the 38-month period of the ongoing HPAI epornitic, 129 million hens were depopulated in comparison to an average of 285 million hens in production. This compares with approximately 302 million in 2020 prior to the onset of HPAI or a deficit of 5.6 percent.

Aerogenous transmission of HPAI from free-living and migratory birds to commercial flocks an epidemiologic reality |

Although Dodge concentrates on Cal-Maine Foods, this company, notwithstanding its dominant position with approximately 42 million hens, represents only 14 percent of U.S. production capacity. The second and third-ranked producers each contributed 7 percent to national production of 7.74 million dozen for both table consumption and breaking in 2024. The top five producers collectively operated 37 percent of the National flock. There is less consolidation in the egg industry and hence greater competition, compared to broiler production with the top five producers responsible for 64 percent of market share by annual volume during 2024 (46.99 million pounds ready-to-cook product).

HPAI is a world panornitic in free-living snd migratory birds and marine mammals |

It is noted that the highest wholesale prices through the first two months of 2025 coincided with significant depopulation as a result of HPAI. Through January and February 2025, 31 million producing hens were depopulated, representing 10.8 percent of the nominal 285 million population in lay. Of this quantity, 19.6 million or 6.9 percent were in cages and 11.0 million were in alternative systems including aviaries, barns and free-range, representing 3.9 percent of the domestic commercial hen population.

The Hill article notes that Cal-Maine received $22 million in indemnity and other payments in compensation for their two complexes that were subject to mandatory depopulation and decontamination. Dodge notes that compensation is provided for “farms that destroy animals in response to disease outbreaks”. As a matter of record, any infected flock is depopulated with the owners having no option since “stamping out” is the current mandatory control method. The USDA APHIS has adopted this policy to reduce farm-to-farm dissemination of avian influenza virus. In 2024 and 2025, the principal route of introduction of virus was in aerosols and entrained on windborne dust. Virus is shed by migratory birds, placing complexes with power-ventilated housing in the four U.S. flyways at high risk. If in the future the USDA wishes to reduce expenditure on depopulation and decontamination then vaccination should be introduced as an additional preventive modality. Even the most stringent structural and operational biosecurity is inadequate to provide absolute prevention from an infection that is responsible for the death of up to 97 percent of a flock following exposure.

In addition to the loss of birds for which federal indemnity has historically been inadequate, all affected producers loose considerable income since repopulation of farms must be scheduled in accordance with the availability of started pullets and the biological restraints of the production cycle. This is especially the case for large multi-house, in-line complexes with more than a million hens.

Dodge claims that the Department of Justice is now “investigating Cal-Maine for alleged price fixing”. This is a potentially defamatory statement and is inaccurate. The Department of Justice is investigating the circumstances under which prices of eggs have risen at retail disproportionately to the expected reduction in supply, confirming extreme price elasticity of shell eggs.

The wholesale price of eggs in the U.S. is established using a benchmark system operated by a commercial entity, Urner Barry. Since as much as 60 percent of shell eggs sold are subject to contracts based on feed and variable costs, the Urner Barry quotation reflects only a proportion of available eggs. This situation results in the amplification of the upward and downward trajectory in price. It is an ironic reality that consumer groups do not complain to the Department of Justice urging investigation of the egg industry when wholesale prices are below cost of production for protracted periods.

The Hill article fails to consider expenditure on conversion to cage-free systems mandated by welfare advocates who have advocated against caged housing. These organizations have coerced retailers, food service suppliers and restaurants to cease purchases of eggs from caged hens. The HSUS and kindred groups have misled citizens in states with ballot initiatives to mandate alternative systems without disclosing the cost implications of affirmative votes. It is estimated that the industry has spent $1.7 to $2.0 billion to convert housing for 50 million hens over the past four years, resulting in higher fixed and variable costs of production. Cal-Maine has expended $293 million in organic growth with the bulk assigned to conversion to cage-free systems. In addition, the company has spent $70 million on improving structural and operational biosecurity in accordance with established principles of disease prevention that were unnecessary before the advent of HPAI.

|

The inherent distortion associated with the Urner Barry price discovery system has resulted in a recent sharp decline in prices. From a peak of $8.11 on March 4th, wholesale prices declined to $3.27 per dozen on April 30th as the level of depopulation during January and February transited to repopulation in the relative absence of infections among large complexes in March and April The 97 percent increase in wholesale price from $2.77 on December 12th 2024 to a peak of $8.11 on March 4th was followed by a 60 percent decline to April 30th. This confirms the distorting effect of the Urner Barry quotation that is independent of manipulation by producers who are in no way in a position to collude or fix prices.

The Department of Justice would be well advised to examine retail margins. There is a considerable lag between a reduction in wholesale price and adjustment of shelf prices, especially with a downward trend in the Urner Barry benchmark quotation.

Dodge advocates government intervention in pricing, even suggesting that indemnity and other compensation as a result of depopulation should in some way be linked to annual profit. Government control of prices is contrary to a free-market economy and is invariably detrimental to producers and consumers.

It is hoped that this commentary with appropriate price and production data and with explanations relating to the price structure of eggs dispels the misinformation and bias expressed by Joel Dodge in the May 1st article in The Hill.